In a recent investor presentation United Utilities Chief Executive Philip Green said that: “we are well prepared for this next price review period (April 2010-2015) and we are confident of delivering out performance.

This confidence stems from a number of actions United Utilities have undertaken:

- Low cost of their debt portfolio of 1.8% real compared to Ofwat’s assumption of 3.6%

- A reduction in the number of employees in their regulatory business of 7%

- Streamlining processes and rationalizing IT infrastructure

- New supplier contracts on improved terms

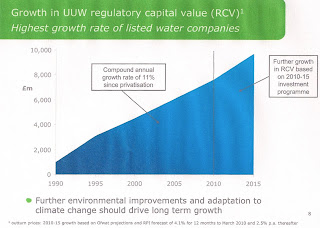

United Utilities have secured an increase in their capital expenditure plans of £400m in real terms compared to the previous AMP period 2005-10, with planned expenditure of £3.6bn. United Utilities are particularly pleased that their regulatory capital value (RCV) will grow by 12% in real terms by 2015.

This is worrying for two reasons. Firstly it shows the continuing importance water utilities place on high cost capital schemes – there is in effect an incentive on the water company to promote the highest capital cost scheme that they believe the regulator will support. This mitigates against finding schemes with the lowest whole life cost especially those with higher Opex. Its also worrying as this high level of growth in the RCV has to be paid for by customers – the question is how much longer will customers accept steadily increasing customer bills?

No comments:

Post a Comment